When regulators asked Americans to weigh in on Basel III Endgame, the opposition was overwhelming.

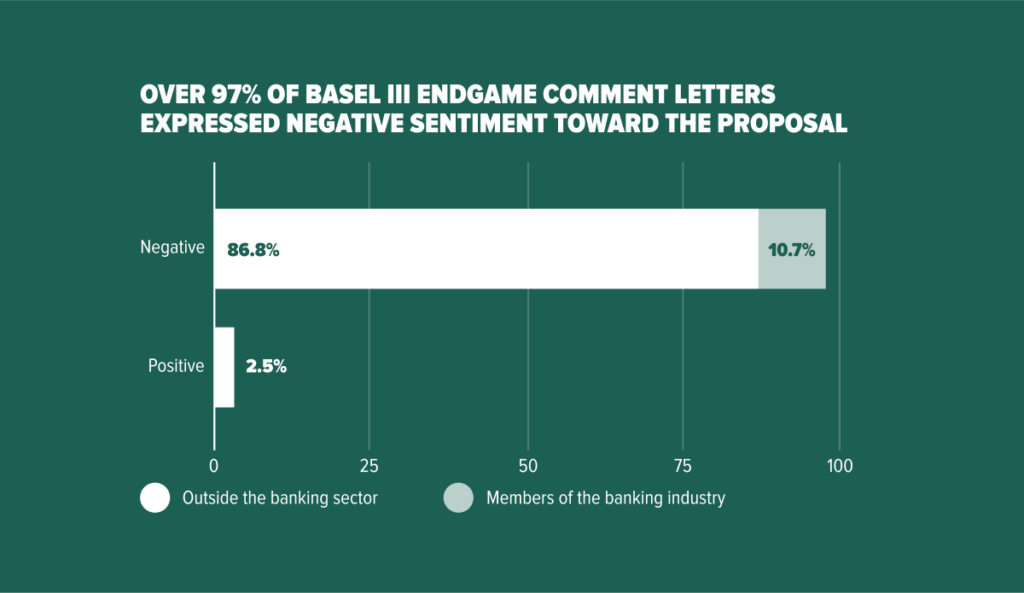

About 97.5% of the Basel III Endgame public comment letters were negative in sentiment, according to Latham & Watkins.

And more importantly, the vast majority of those negative comments – over 86% – came from outside the banking sector, including 25% from elected officials on both sides of the aisle, 10% from agriculture and energy groups, 9% from housing and real estate organizations, and 6% from small business.

Take, for example, this response from a leading housing organization:

The National Association of Home Builders expressed concern that the proposal would reduce access to mortgage lending, which would "harm home builders, home buyers, homeowners, and the housing economy." "The home builder community depends on home buyers having access to financing. We are concerned the proposal will create disincentives for depository institutions to offer mortgage loans. This likely will cause banks to increase the cost of mortgage financing or exit mortgage lending and related activities, reducing mortgage options for borrowers. Actions that make mortgage loans more expensive or reduce their availability will harm home builders, home buyers, homeowners, and the housing economy." (Jessica R. Lynch, National Association of Home Builders, Letter, 1/16/2024)

Americans told regulators that they cannot afford Basel III Endgame. They should listen to the public and re-propose the rules.