Tomorrow, Federal Reserve Vice Chair for Supervision Michael Barr will be giving remarks on Basel III Endgame, where he will "preview the regulators' revised proposal and explain the next steps." Here are three things you should keep in mind before Barr's remarks:

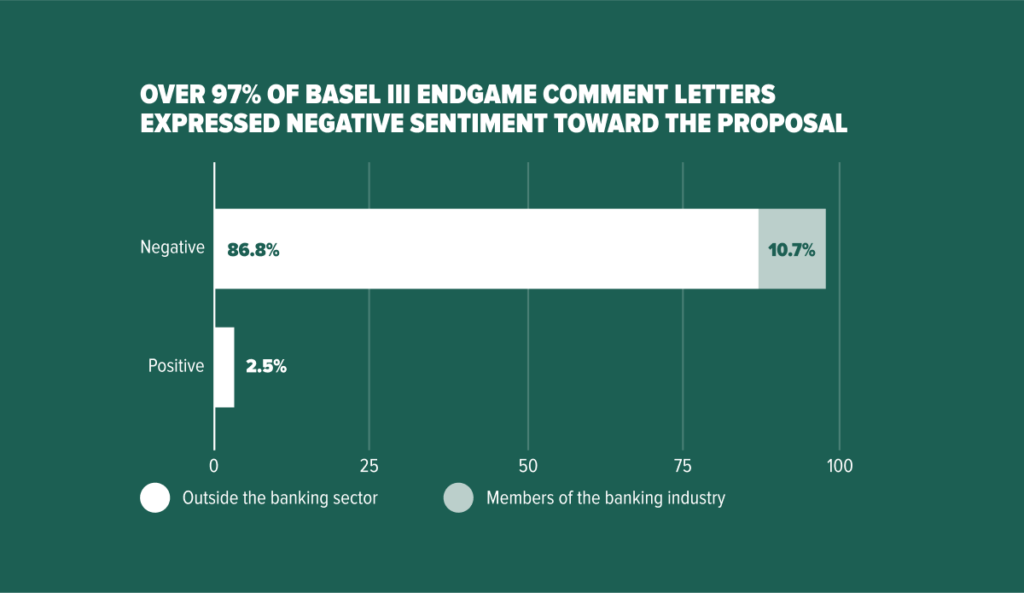

1. The opposition to Basel III Endgame is overwhelming and diverse. About 97.5% of the Basel III Endgame public comment letters were negative in sentiment, and the vast majority of those negative comments—over 86%—came from outside the banking sector.

2. The largest U.S. banks are already highly capitalized, strong, and resilient. The Global Systemically Important Banks, or GSIBs, have more than tripled their high-quality capital in the past 15 years. Capital requirements for the Global Systemically Important Banks, or GSIBs, have also more than doubled from 4.5% in 2015 to 11.5% in 2023 on average, inclusive of buffers.

3. As originally proposed, Basel III Endgame would harm people and businesses across our economy. In Part II of its report on Basel III Endgame, PwC concluded that, if implemented as proposed, the proposal could result in a decline in GDP by approximately half a percentage point. Given the average GDP growth rate over the past 10 years is 2.1%, a negative outlook scenario would cause a roughly 25% decline in GDP growth, the authors say. The study provides further evidence that under the proposal, banking products and services would not only become more expensive and less available, they would have knock-on effects, impacting every sector of the economy.

"Increasing capital is not free," Forum President and CEO Kevin Fromer said to the Federal Reserve Board, Federal Deposit Insurance Corporation, and the Office of the Comptroller of the Currency in January. "The costs of the proposed changes would inevitably be borne by American families and business. The largest banks are already well capitalized. This proposal would impose enormous burdens with little or no marginal benefits."